Employee salary tax calculator

In Kenya the government manages the PAYE tax through the Kenya Revenue Authority KRA which collects the statutory contributions from the employer before salary and wages are paid to the employee. Salary Tax Calculations Annual Salary Salary Tax Calculation.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

In Luxembourg the income is subject to a pay-as-you-earn PAYE system.

. Among the elements can have a major impact on what the employee does such as the kind of tax exemptions claimed. This tax calculator is only indicative. You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our.

Social security contributions in Spain have a minimum and maximum cap determined by the employees level of studies. I Am An Individual. The above calculator provides for interest calculation as per Income-tax Act.

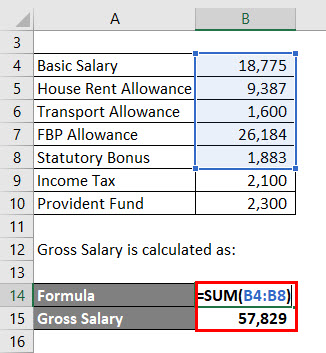

Salary structure is the details of the salary being offered in terms of the breakup of the different components constituting the compensation. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. Gross to net in BC 2022.

Both the employer and the employee contribute 12 of the employees basic salary each month to the EPF or employee provident fund. Corporation Tax Calculator 202223. Any changes to the salary structure ie.

Of taxes Total Taxes Payable Rebates Allowed Total PAYE Taxes Payable after Rebate UIF Employee Portion max R2 12544 Total PAYE and UIF Effective Tax on Salary Company. United States Minimum Wage Calculator. Would take into account your gross income and any exemptionsdeductions claimed under section 80C of the Income Tax Act of 1961.

Covering more than 90 cities in China Direct HRs Salary Calculator provides total employer cost gross or net salary for any given value. UK Tax. Basic salary forms the core of the salary structure constituting 40-45 of the total CTC.

References to taxation are based on our understanding of the current law and practice and may be affected by changes in legislation or an individuals personal circumstances. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. United States Minimum Wage Calculator.

Sales tax calculator GST QST 2015. Salary Income Tax Calculators. Canada emergency response benefit 2020.

The contribution made by the employee towards the EPF is available for a deduction under Section 80C of the Income Tax Act 1961. AM22Techs Indian salary calculator is easy to use if you know your salary package. A salary tax calculator can help you calculate tax online making the process of income tax computation an easy one for you.

South African Tax Calculator 2023 with 3 years comparison Note. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. United States US Tax Brackets Calculator.

It is typical for employers to increase an employees salary at least 3 to 5 every year to adjust for inflation and and increased cost of living although this is not required. UK Tax. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

UK Tax Salary Calculator. Low income earners salary less than 10225 EUR do not pay income tax but after this amount the tax grows until 45 for individuals who earn more than 160366 EUR. UK Tax.

The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements health FSAs health savings accounts HSAs health reimbursement arrangements HRAs or Archer medical savings accounts Archer MSAs. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

Salary exchange may reduce the employees entitlement to statutory benefits means tested benefits tax credits or other salary related finances for example mortgages. The standard rate for the employee is 635 while the employer pays at least 2990 of an employees salary depending on the occupation. SalaryWage and Tax Calculator - calculate taxes gross wage and net wage.

Is a tax paid by both the employee and the employer. United States US Tax Brackets Calculator. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023.

The salary calculator exactly as you see it. Enter the Basic Salary HRA and other income as listed on your CTC. Select the columns you would like to display on the wage summary table.

Costs for home testing and personal protective equipment PPE for COVID-19. Salary Income Tax Calculators. Calculate your dividends with the most comprehensive dividends and salary tax calculator available for UK taxpayers.

SalaryWage and taxes in Estonia. SalaryWage and taxes in Latvia. This income tax applies to all employees permanent temporary full time and part time except for the employment that is not longer than 1 month.

For employee and individuals. United States Salary Tax Calculator 202223. United States Salary Tax Calculator 202223.

Unemployment insurance employee 16 Funded pension II pillar Employee didnt apply for temporary rise of payments. 8828840199 9 am - 7 pm. Individual Income Tax IIT.

The calculator will find the total yearly income tax and then show you the monthly deductions and monthly net income that should be credited to your bank account. Sales tax calculator British-Columbia BC GSTPST 2016. Employee contribution to the provident fund.

Gross to net in Ontario 2022. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. UK Tax.

This places Luxembourg on the 1st place in the International Labour Organisation statistics for 2012. On top of this number you will likely want to add an additional percentage to account for merit salary increases. The average monthly net salary in Luxembourg LU is around 3 367 EUR with a minimum income of 1 922 EUR per month.

Other salary components like Gratuity Provident Fund and ESIC are determined according to the basic salary. Let us understand Basic Salary. Corporation Tax Calculator 202223.

The taxes social security contributions and income tax are deducted monthly. Taxation in France Income Tax on personal income is progressive with higher rates being applied to higher income levels four tax brackets. Applied for rise of payments during 2014-2017.

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax On Salary With Example

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate 2019 Federal Income Withhold Manually

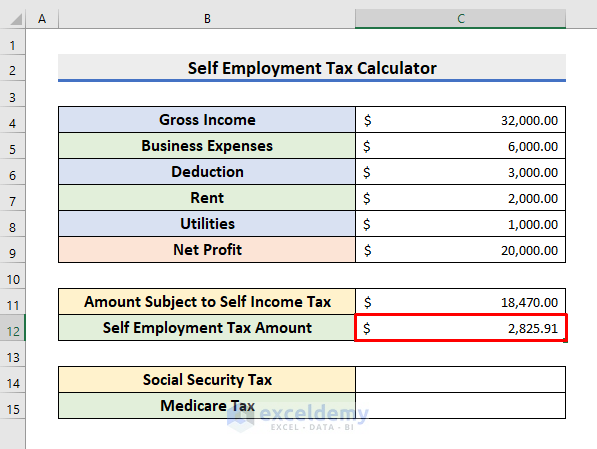

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Income Tax On Salary With Example

Payroll Tax Calculator For Employers Gusto

Calculate Income Tax On Salary Sale 52 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Formula Calculate Salary Calculator Excel Template

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator